A TAX bombshell dropped on 53,000 self-employed people in Oxfordshire will strike a ‘tremendous blow’ to the county’s economy, it is warned.

White van men, plumbers and cabbies are all set to be affected by the change to National Insurance, with a cut to dividend allowances set to clobber business owners.

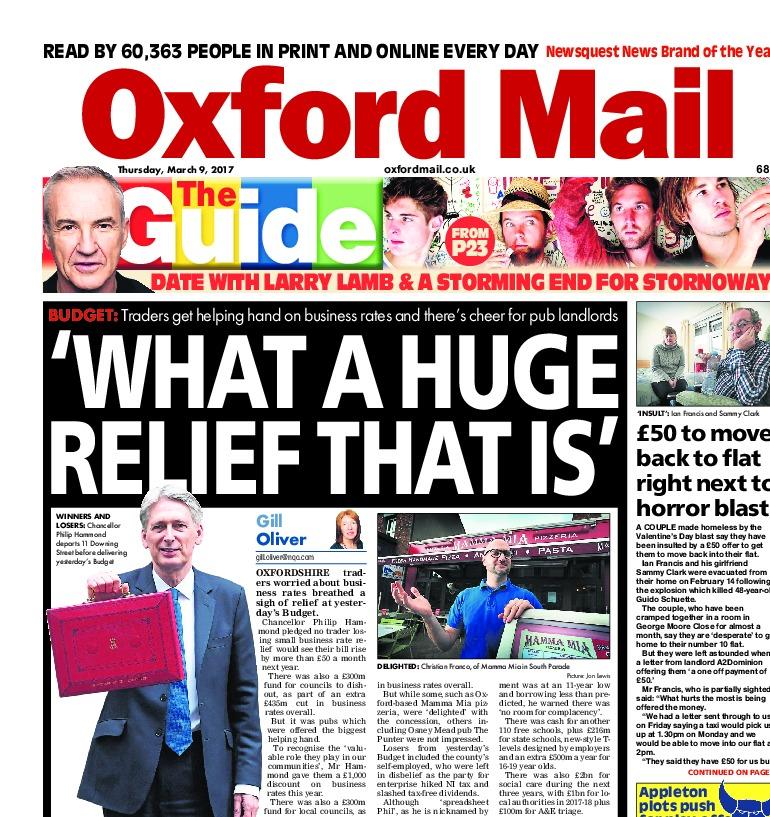

Chancellor Philip Hammond insisted the moves were ‘fair and appropriate’ but yesterday he was accused of breaking Conservative election promises and ‘singling out’ self-employed people.

The scale of the change was laid bare yesterday by figures from the Office for National Statistics (ONS), which showed one in eight county workers would be affected.

Oxford businessman Spirit McLoughlin, owner of Spirit Heating and Gas Services, yesterday said it would heap extra costs on already struggling firms.

He added: “It just seems like the Government is out to take everything it can get.

“Working people haven’t got a chance unless they start treating us more fairly. We are being taxed to the hilt and the cost of materials is also going up, but the Government is singling us out.”

And taxi driver Colin Dobson, of Abingdon, added: “Self-employed people already do not get most of the benefits employed people do.

“The simple fact is many of us end up working for less than the national living wage but this process of attrition is eroding how much we can earn.”

Changes announced by Mr Hammond in the Budget on Wednesday would see National Insurance contributions for self-employed people rise from nine per cent of profits to 10 per cent in April 2018 and 11 per cent in April 2019, costing those affected an average of £240 a year.

It would raise £600m for government coffers by 2020/21 but breaks a key Tory promise from 2015 not to raise taxes for five years.

Free dividend allowances would also fall from £5,000 to £2,000 next year, raising £825m by 2020/21.

Top think tank the Institute for Fiscal Studies welcomed the changes, arguing differences between employment forms were ‘costly, inefficient and unfair’.

It was also defended by Robert Courts, the recently-elected Tory MP for Witney, whose constituency has the highest proportion of self-employed people in the county.

According to the ONS, there are 12,600 self-employed people in Witney – a fifth of the total workforce.

Mr Courts, who six months ago was a self-employed barrister, said: “The key thing to remember is National Insurance funds the NHS and pensions.

“We’ve been looking for ways to give the NHS the money it needs and that’s the motivation.”

He said an employee earning £32,000 a year would pay almost £4,000 more than a self-employed person earning the same under current rules.

But Liberal Democrat Liz Leffman, who lost to Mr Courts in a by-election, said: “I run my own company and I can tell you when you have just started up every penny counts. Having to pay extra is going to be a tremendous blow.

“If we want Britain to be successful, we must support the self-employed.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel